The Federal Reserve (Fed) will probably maintain its short -term key interest rate without changes on Wednesday, despite the weeks of harsh criticisms and demands of the president of the United States, Donald Trump, that the FED reduces the costs of loans.

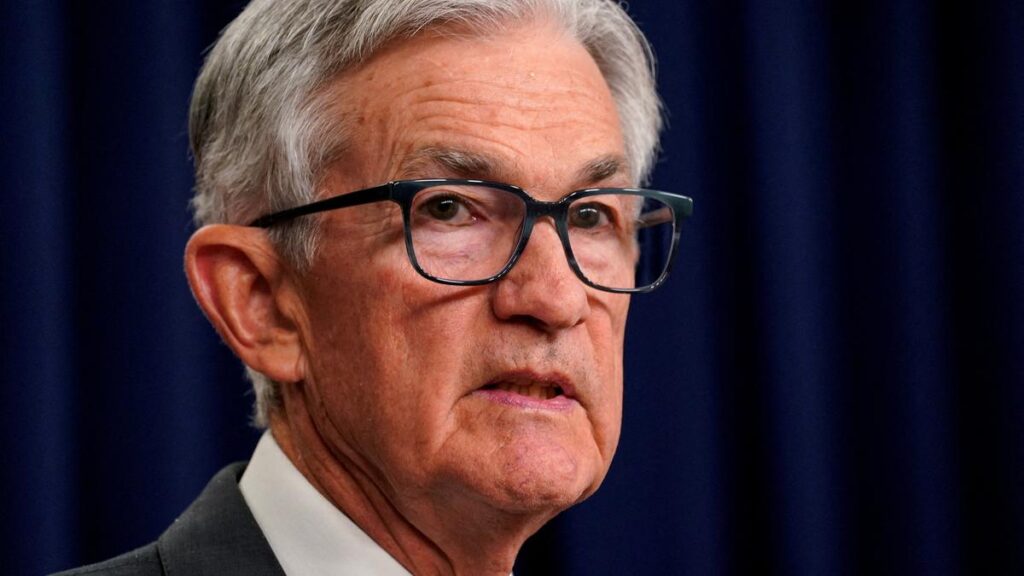

After causing a strong fall in the financial markets two weeks ago, saying that he could say goodbye to Fed President Jerome Powell, Trump later retreated and said he had no intention of doing so. Even so, he and Treasury secretary, Scott Besent, have said that Fed should reduce rates.

They argue that inflation has constantly cooled and that high indebted costs are no longer necessary to restrict price increases. The Fed abruptly increased its short -term rate by 2022 and 2023 as inflation of the pandemic era.

Separately, Elon Musk, head of the Efficiency Department of the Trump Government (Doge), suggested that Dege should look more closely at the Fed expense in its facilities.

Good scrutiny shows that even when the Trump administration supports its threats to shoot Powell, the Fed is still subject to unusual acute political pressures, despite its status as an independent agency.

Even so, the Fed will surely leave its key rate without changes in approximately 4.3% when it meets on Tuesday and Wednesday. Powell and many of the other 18 officials who sit in the Fed Rate Establishment Committee have said they want to see how Trump’s rate affects the economy before making any movement.

However, Trump said Friday on the Social Network Network platform that “there is no inflation” and said that the prices of supermarkets and eggs have fallen, and that the gas has fallen to $ 1.98 per gallon.

That is not entirely true: the prices of the groceries have increased 0.5% in two of the last three months and have increased 2.4% for a year. Gas and oil prices have decreased: gas costs have dropped by 10% for a year, continuing a tendency that has continued that has continued in part due to the phrases that will be arranged will be weaving. Even so, AAA says that gasoline prices average $ 3.18 per gallon.

Inflation ceased to warn in March, an encouraging sign, designed in the first three months of the year that was 3.6%, according to the Fed preferred meter, well above its 2%target.

Without tariffs, economists say it is possible that Fed soon reduces its reference rate, because it is currently at a level for loans and slow expenses and cold inflation. However, Fed now cannot reduce rates with Trump’s general tariffs that prices will probably increase in the coming months.

Vincent Reinhart, Chief Economist of BNY, said that the Fed is “marked” for what happened in 2021, when prices rose in the midst of supply supplies and Powell and other Fed officials said that the increase would probably be “transitory.” Instead, inflation rose to a peak or 9.1% in June 2022.

This time they will be more cautious, he said.

“That is a Fed that will have to expect evidence and be slow to adapt to that evidence,” Reinhart said.

In addition, Trump or Powell’sos makes it difficult for the FED chair to reduce the rates because doing so would soon be seen as a knuckle in the White House, said Preston Mui, an economist of America employee.

“You could imagine a world in which there is no pressure from the Trump administration and reduce rates … Soner, because they feel comfortable by arguing that they care about the data,” he said.

For his part, Powell said last month that tariffs would probably increase inflation and slow down the economy, a complicated combination for Fed. The central bank would generally increase rates, or at least keep them high, to combat inflation, while reducing them to stimulate the economy if the unemployed increased.

Powell has said that the impact of tariffs on inflation could be temporary, an increase in prices of a moment, but more recently he said that “it could also be more persistent.” That suggests that Powell will do it because to wait, potentially for months, to ensure that rates do not subjute inflation before considering a rate cut.

Some economists predict the Fed won the reduction rates to its September meeting, or a little later.

However, Fed officials could move before if tariffs hit the economy strong enough to cause dismissals and push Umnempleoyent. Wall Street investors seem to wait for such a result: they project that the first cut will occur in July, chording at the prices of futures.

Separately, Musk criticized the Fed on Wednesday for spending $ 2.5 billion in an extensive renewal of two or their buildings in Washington, DC

“Since at the end of the day, all this is taxpayers’ money, we must change their appearance to see if in fact the Federal Reserve is spending $ 2.5 billion on its interior designer,” Musk said. “That is an eyebrow assailant.” Fed officials recognize that the cost of renovations has increased as the prices of construction materials and workforce have fired in the middle of inflation after the pandemic. And the former Fed officials, who speak in a history, say that local regulations forced the Fed to make more of the underground expansion, instead of making the buildings higher, which joined the cost.

Meanwhile, Kevin Warssh, a former Fed governor and a potential candidate to replace Powell as president when Powell’s term expires next year, he recently said that the Fed has attracted greater scrutiny because in the control price.

“The current Fed wounds are largely self -inflicted,” an international monetary background conference at the end of April, in which he also criticized the Fed for participating in a global forum on climate change. “A strategic restart is necessary to mitigate credibility losses, changes in position and most importantly, worse economic results for our fellow citizens.” Powell, on the other hand, said last month that “fed independence is very widely understood and supported by Washington, in Congress, where it really matters.”

More like this

Posted on May 5, 2025

]