The Unified Pension Plan (UPS), which guarantees the pension to the employees of the central government, has been launched as of April 1. Government employees enrolled in the National Pension System (NP) have had the option to change the changers Joine before governors Beye Bedy feel the Saturday time in seem curled up to seem curled up. UPS within 30 days after your Union service. The reports suggest that the initial response to UPS has been warm. But for most employees, it makes sense to change to UPS.

Ups versus NPS

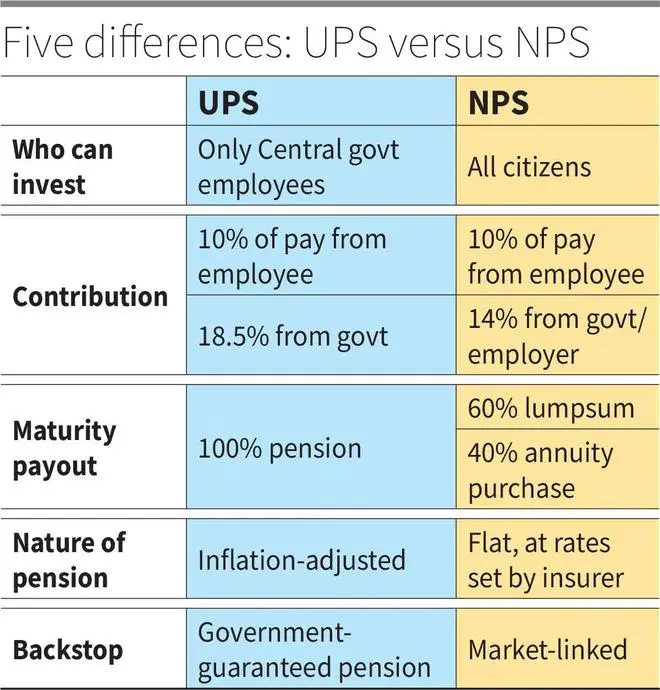

There are four main points of difference between NP for government employees and UPS.

Contributions: According to NPS, you contribute 10 percent of your basic payment plus the assignment of meats to the NPS account level 1 each month. This sum is automatically deduced from your salary. The central government also contributes 14 percent of its basic payment in its NPS account level 1. These contributions grow over time to finance its guest house. Under UPS, its contribution will remain at 10 percent, but the government’s contribution will be 18.5 percent. However, only 10 percent of the government’s contribution will be paid in its NPS account, and 8.5 percent of removing in a common group. This 8.5 percent will not be paid at maturity.

Investment options: Under NPS, it is free to choose how your contributions will be invested. You can assign all your contribution to debt instruments or opt for the two funds of the life cycle that assign 25-50 percent to shares and the rest in debt. But under the UPS, the Government assumes that the assignment of default assets, which currently invests around 85 percent of debt contributions and 15 percent in shares. While employees who opt for UPS can deviate from the default option, the calculations assume that the contributions are invested in the default option. If the employee opts for a different assignment and the corpus does not match the default option, the employee must fill the vacuum to obtain the insured guest pension. If the corpus exceeds the default option, the excess will be paid to the employee. This makes the default option for the safe option for government employees looking for a guaranteed pension under UPS.

Bullee to maturity: NPS allows subscribers to withdraw 60 percent of their expiration processes as a lump while using the remaining 40 percent to buy a pension plan of the approved insurers. But with UPS, 100 percent of the amount of expiration is tasks by the government to deliver a guaranteed pension to the employee. This pension will continue as a lifetime. The family pension will be paid to 60 percent of the guest house complete to the spouse.

PENSION PAYMENT: The NPS does not guarantee any pension to subscribers. From the corpus they accumulate their working life, employees must invest 40 percent in approved annuities of insurers at the time of retirement to obtain a pension. Therefore, NP’s quantum pension is based on the market yields of its contributions and the annualities offered by insurers when it retires. Insurers provide fixed pension payments that do not adjust for inflation. In the UPS, 100 percent of employee contributions in the scheme (under the breach pattern) is transferred to the government, which promises to pay a 50 percent life pension for the last salary of employees. The pension will be adjusted periodically by inflation.

50 percent of the guest house is linked to a complete 25 years of service with the government. If the service is lower, the pension will be reduced. Employees must have a minimum service of 10 years to be eligible for the UPS pension.

Why change

There are three reasons why changing UPS makes sense for most government employees who plan career changes.

One, the UPS allows them to obtain a guest house adjusted to 50 percent of their salary on the last day, contributing only to 10 percent of their most pay payment during their years of work. The calculations show that administering a pension adjusted by inflation on their own may require much higher contributions. For example, Nisma’s retirement calculator shows that a 35 -year -old player with monthly expenses of ₹ 1 Lakh today may need to invest at least ₹ 30,513 per month for the next 25 years to reach the retirement corpus or a condition of ₹ 5.73 million rupees. This calculation is based on some change of a advertiser in any of these numbers could further inflate their savings needs.

The accompanying table, using the nismal calculator, shows the monthly sums that must be invested (to a yield of 12 percent) to reach a pension adjusted to inflation after retirement. The numbers clearly show the proportion of income that you will have to invest for retirement increases sharply depending on your age. Therefore, the closer to retirement, the more sense it will make to opt for the UPS. You can execute your own numbers in the calculator to know your investment objectives.

Two, although delivering more than 100 percent of its retirement corpus to the Government in retirement may seem discouraging, the government is compensating this by contributing 8.5 percent of its basic payment of common payment, to fulfill any deficit in its pension in retirement. As you should contribute only to 10 percent of your basic payment to UPS, you will have space to use your savings beyond this, invest in other objectives or complement your pension. You can invest this excess in the NPI 2 or mutual funds account to accumulate an independent bulge of the NPS/UPS.

Three, while those who start early (in their 20 or 30 years) have a good opportunity to reach the Target retirement corpus, this requires regular savings and being disciplined about their retirement accumulation plan in the next 35 or their work. The alleged underlying retirement planning, such as the 12 percent yield assumption, inflation assumption of 6 percent and the longevity of 85 years, may be subject to changes. Periodic correction episodes in shares and bond markets can also raise a behavior challenge to maintain the course. This will require a periodic review and the alteration of your investment plans. Only people who are disciplined and passionate about investment can administer it.

Four, under NP, his pension in retirement will be decided not only by his accumulated corpus but also by the annuity rates offered by the insurers. These have tended to be below the fixed deposit rates and do not sacrifice the inflation adjustment. With UPS, the responsibility of providing a monthly guest house to 50 percent of its salary on the last day and adjusting it for inflation, falls to the government. This relieves the concern of tracking the rates and handling the risks of reinvestment after retirement.

In general, the only people who need to think twice before opting for UPS are employees of 20 -year investments and employees who do not plan to continue with the government service for about 10 years.

Takeways for private employees

Private sector employees in India are not lucky enough to have access to a guaranteed and adjusted pension for inflation. But UPS design also has lessons for them.

On the one hand, the UPS design shows that to establish a pension at 50 percent of their salary, government employees together with their employer must save 28.5 percent of their salary during their working life (the contribution of 10 percent of the employee). Private sector employers may not be willing to register with 18.5 percent of employee’s salary trailers. This is so special if it already has an EPF account where the employer contributes 10 or 12 percent. Therefore, you can depend on you to ensure you intensify your retirement savings.

Two, UPS guarantees the 50 percent pension or the last day of payment only if the employee contributes for 25 or more years. This underlines the need for an early start in your own retirement plans, if you are an employee of the private sector or adapt to yourself.

Three, UPS proposes to invest contributions in market -related instruments that are a combination of debt and capital. Currently, the default NPS option invests 85 percent in government and corporate bonds and 15 percent in shares. Only with this, the center does not rule out a deficit in the retirement corpus, so it is leaving aside 8.5 percent of its contribution in a common group. As a private employee, this shows that you cannot trust the EPF oriented to debt to build your retirement corpus. You need exposure to equity. You can build this exposure through indices (NIFTY100, NIFTY MIDCAP 150) or active funds of great capitalization and capitalization of highly qualified capitalization. Alternatively, you can use the NPS Tier 2 account to obtain a heritage plus the exposure of the debt similar to the UPS. By having a higher capital allocation of, say, 30-40 percent, you can settle for a monthly contribution lower than 28.5 percent planned by UPS.

In general, UPS is a call for attention that if you seek to finance a comfortable retirement and keep up with inflation in your retirement years, then starting as soon as possible and saving 25 percent more of your income is your best option.

Posted on May 10, 2025

]