Among the real estate players who witnessed an excellent change in their fortune in the rise of residential and commercial construction after fiscal year 21, Anant Raj was an outstanding beneficiary. An important additional promoter for the action was the company’s foray into the business center business, he thought that the segment itself has not yet contributed significantly to general income.

After a relentless race, the action has dropped more than 50 percent in its peak recently in January. Although the correction in the largest markets triggered by the sale of FPI, the weakness of corporate profits and the challenges of US commercial rates.

There was also excessive pessimism about the perspectives of the native business in the company’s cloud/storage after the deep artificial intelligence announcement led him to feel that the world’s world data center would face a reduction (this aspect will be discussed later).

A ₹ 450, the shares are listed 25 times their earnings per share for fiscal year 26, so it is a reasonable commitment to investors with a perspective of two or three years, especially given the high valuations that most of the really large ones. The Realty BSE quotes multiple physical education or approximately 48 times.

The solid traction in its luxury residential construction business voltage and affordable segments, visibility in its commercial division and healthy demand in its data center, which is expected to begin contributing to the income significantly in the next two and two and positive.

The company also has a healthy balance with very insignificant ordered levels.

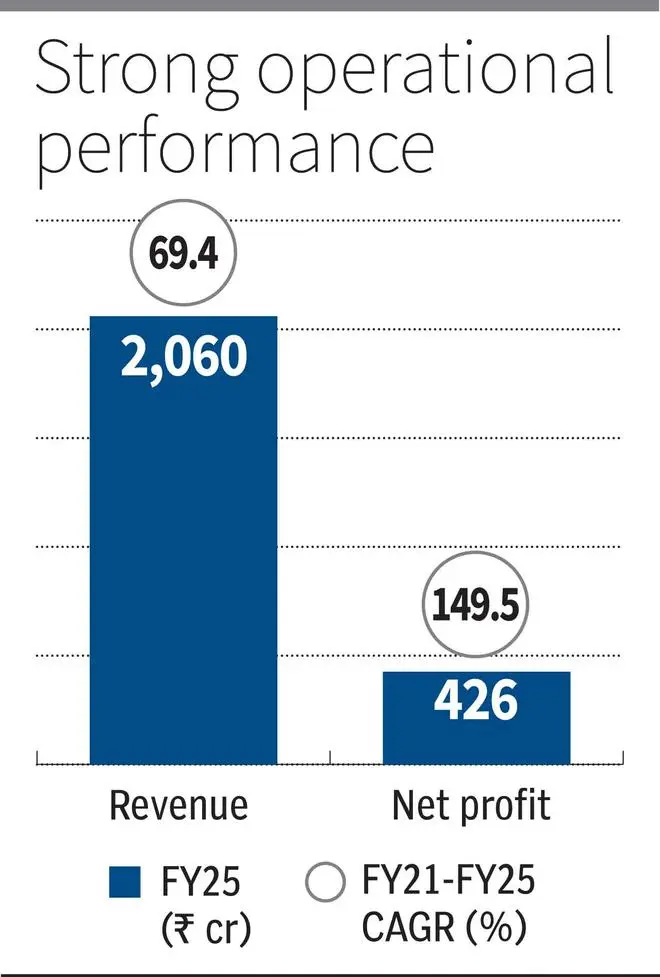

Around the fiscal year-25, Anant Raj’s revenues grew by 69.4 percent aggravated annually to ₹ 2,060 million rupees, while net earnings increased by 149.5 percent to ₹ 426 million rupees in fiscal 2000.

Multiple real estate levers

The firm is largely a real estate player focused on the NCR region (mainly in Gurugram). Residential luxury projects, group housing, affordable homes (in Trupati), suddenly and villas are areas in which it specializes.

There are voltage projects of 220 acres of integrated development in Gurugram. Around 10.87 million square feet of current projects and planned are on the horizon, with a total expected income of ₹ 22000 million rupees in the coming years.

Since it operates in a high -end area or Gurugram, the achievements in residential projects are high. In its group housing project, for example, the average sale price is ₹ 18,000 per square feet.

Anant Raj also has excitation hotels for commercial space segments, IT parks and office spaces. These companies have a visibility of constant rental income in the predictable future.

Data centers that come to the current

Anant Raj has been providing joint location services since 2019. In recent years, it has also begun to offer cloud services (infrastructure as a service) in association with Orange Business. It intends to enter enabled solutions for AI as well.

For Q1Fy26, the company expects up to 28 MW to the capacity center of the data center. Around the next five years, he hopes to have around 300 MW in operation.

Segment income is currently insignificant. However, after the capacity of 28 MW is put into operation, the data center segment can contribute significantly (more than 10 percent) of the revenues of fiscal year 2016. Around the next two or three years, as more capacity is transmitted, around 25-30 percent of the company’s income can be generated from the segment.

The key aspect to take into account is that the business center business generates an operational margin or 75 percent or more. Then, when more income flows, the company’s margins would expand.

Anant Raj had mainly public sector companies as clients in their data centers so far, but more and more, even private companies are looking for their cloud services.

The increase in the use of electronic commerce, the fastest deployment of 5G, the explosion of cloud computing and compliance with the data protection law are triggers of growth for the company. AI and automatic learning would be future drivers.

Anant Raj has the additional advantage of having its own real estate to house data centers under its large land bank.

The capacity of the Indian data center crossed 1 GW in 2024, according to a recent report by JLL India, tripling from the 2019 levels. Much of the capacity is absorbed. Another 795 MW is expected to be added around 2025-27. The average income per kVA per month for a 5-20 MW capacity data center are ₹ 7,000 in Mumbai. An MW is 1,000 kva.

According to another report by Anarock Capital, the Indian Data Center industry has a value of $ 10 billion currently and generated an estimated $ 1.2 billion for operators in 2023-24.

At Deepseek entry, the reduction in the requirements of the data center due to the lowest computational infrastructure requirements to train large language models, a recent Goldman Sachs report provides clarity. He points out that questions about training, infrastructure and Deepseek’s ability remain. The report indicates that the Data Center dedicated to AI is an emerging infrastructure class and that there are currently very few. The global energy demand for data centers will increase 50 percent by 2027 and up to 165 percent for the end of the decade (compared to 2023), according to Goldman Sachs research estimates.

In addition, the newly informed results of the quarter of March and Cy26 Outlook of the USA. UU. Big Tech Companies-Microsoft, Alphabet, Meta Platforms and Amazon also confirm this. Its Cy26 mega capex plans related to the data center/cloud of AI remain intact, since customer demand remains strong in this segment.

Strong financing

Anant Raj has been reducing debt in his balance sheet in recent years. In fiscal year 2015, its net debt is only $ 50 million of rupees and the relationship of debt / ordered equity is badge.

The company enjoys a high margin of ebita or 25 percent and a net margin or more than 20 percent, which favorably compares the industry. Once the business of high margin data centers begins to contribute significantly to the finances of fiscal year 26, the margins would go to the north.

Posted on May 3, 2025

]