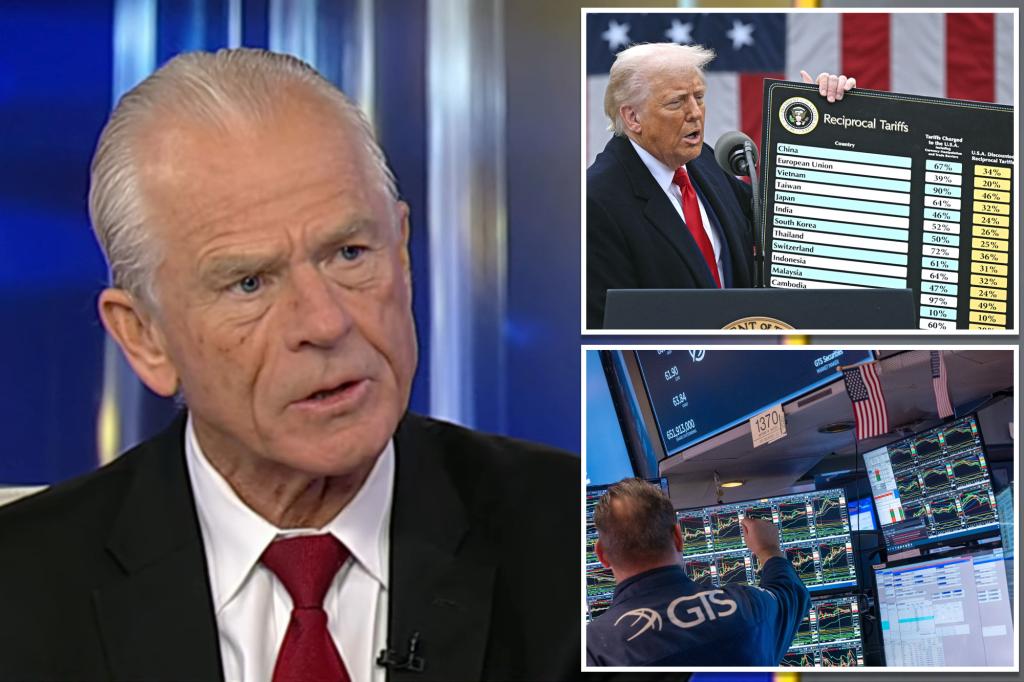

The main commercial advisor of the White House, Peter Navarro, “guaranteed” that the United States will not face a recession under President Trump and said there would be no inflation despite the information about their “day of release day” tariffs.

Navarro’s promise occurs in the midst of Wall Street’s concern that the US economy can already be hiring after the broad Trump announcement of the new rates last week.

“He is finding a background now,” Navarro said about the free fall of the stock market with Fox News host “Ingraham Angle” Laura Ingraham on Monday night.

“But look, here is the thing, it will change, and they will be companies in the S&P 500 that are the first to produce here,” he added. “Those are the ones who will lead to recovery, and it will happen.”

Navarro then made a couple or bold economic predictions.

“Dow: 50,000, I guarantee it, and I do not guarantee that there is no recession,” said the White House official.

Navarro’s confidence comes from his belief that Congress will soon be acts on the president’s economic agenda, including the disposal of taxes on tips and the payment of overtime and the tax cuts authorized by the first mandate of King Trump.

“Why? Because when we spend the largest and most broad tax cut in history, in a matter of months, it will be a great stimulus,” said Trump’s advisor.

“There will be no inflation,” Navarro continued. “We have already had a significant fall, a great drop in oil prices, is like a point outside the [inflation index]. We will have lower yields and mortgage [rates]. ”

In contrast, the Blackrock CEO, Larry Fink, told the New York economic club on Monday that most business leaders already feel that the nation is in an economic recession.

“Most of the CEO with whom I speak would say that we are probably in a recession at this time,” Fink said.

A recession is a period or significant decrease in economic activity that lasts more than a few months. In general, it is recognized by two consecutive rooms or negative growth of the Gross Domestic Product (GDP).

Trump’s reciprocal rates plan has toured the stock market, but it is too early to know what load effect will have on economic growth.

In the first two days after Trump’s announcement last week, the S&P 500 index collapsed 10.5%, the largest loss of two days since March 2020.

The Dow Jones Industrial Average fell more than 300 points on Monday and is more than 10% below its December record closure.

Meanwhile, the Nasdaq compound rose less than a percentage point on Monday, but confirmed that it was in a bearish market, defined as a decrease or 20% or more below its record closure, according to Reuters.

Navarro confirmed that foreign leaders are calling the White House and desperately trying to make an agreement to reduce the new rates, but argued that they are focusing incorrect.

The leaders are “saying” that we want to talk. We will reduce our rates to zero if you lower yours “… that is not the problem,” Navarro said.

The commercial advisor cited the example of Vietnam, which was beaten with a 46%tax, and sells “$ 15 for $ 1 that we sell them.”

“Zero tariffs would not give us a reduction in the deficit of $ 123 billion that we have,” Navarro argued, adding that “$ 5 of those $ 15 sells us … is China.”

“They don’t buy anything of us and want to go to 0-0.”

]